OH Bob Evans Form 335 2009-2026 free printable template

Show details

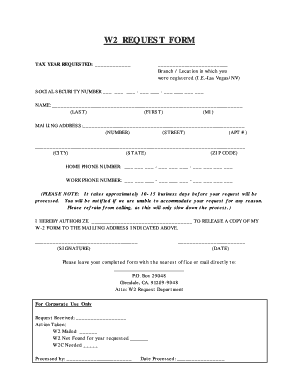

Form #335 Implemented 12/09 EMPLOYEE'S REQUEST FOR DUPLICATE W-2 FORM OR ADDRESS CHANGE FOR FORMER EMPLOYEES I am/was employed by: Employee Name Bob Evans Farms Mimi's CAF To protect your privacy,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign bob evans application form

Edit your olive garden w2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bob evans job application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OH Bob Evans Form 335 online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OH Bob Evans Form 335. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OH Bob Evans Form 335

How to fill out OH Bob Evans Form 335

01

Gather necessary information: personal identification, income details, and any relevant documentation.

02

Begin with Section 1: Fill in your name, address, and contact information accurately.

03

Proceed to Section 2: Provide your Social Security Number and date of birth.

04

Complete Section 3: List your employment history, including employer names and durations of employment.

05

Move to Section 4: Describe your financial situation, including income sources and amounts.

06

In Section 5, answer any questions regarding assets or additional financial resources honestly.

07

Review the form for completeness and accuracy to avoid delays.

08

Sign and date the form at the designated section before submission.

Who needs OH Bob Evans Form 335?

01

Individuals applying for financial assistance or benefits related to OH Bob Evans.

02

Employees seeking to report specific employment-related information.

03

Residents of Ohio needing to document their financial status for state programs.

Fill

form

: Try Risk Free

People Also Ask about

Do employees get a discount at Olive Garden?

Enjoy a 25% discount on food and non-alcoholic drinks at all our restaurants for you and up to seven guests, plus 100,000 discount offers from brands you love.

Do Family Dollar employees get a discount?

No you don't get any discounts or anything as a family dollar employee.

Do Bob Evans employees get a discount?

Yes, Bob Evans offers employees discounts on food purchases. The exact amount of the discount varies by location.

Who does Bob Evans use for 401k?

Bob Evans Farms offers BOB EVANS FARMS, INC. AND AFFILIATES 401(K) RETIREMENT PLAN through Prudential. Their plan covers 31050 employees.

What is the Chick Fil A employee discount?

Is There a Chick-fil-A Employee Discount? Nothing official. There doesn't seem to be any official/concrete employee discount policy if you work at Chick-fil-A and order food when you're not working.

Do you get a discount if you work at Dollar Tree?

Employees don't get discounts Dollar Tree employees reportedly don't receive discounts, although a few select accounts claim employees only receive discounts on damaged goods, per the Assistant Manager at the Dollar Tree. Here are 11 things you should have been buying from the dollar store this whole time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OH Bob Evans Form 335 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including OH Bob Evans Form 335. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my OH Bob Evans Form 335 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your OH Bob Evans Form 335 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out OH Bob Evans Form 335 on an Android device?

Use the pdfFiller mobile app and complete your OH Bob Evans Form 335 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

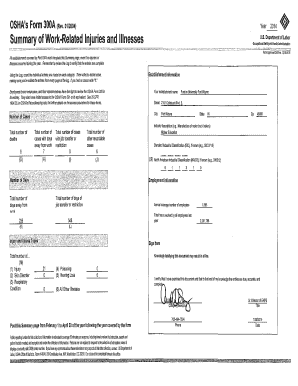

What is OH Bob Evans Form 335?

OH Bob Evans Form 335 is a state tax form used in Ohio for reporting income, deductions, and credits related to business operations under the Bob Evans tax incentive program.

Who is required to file OH Bob Evans Form 335?

Businesses that participate in the Bob Evans tax incentive program and are claiming tax credits or deductions related to their operations in Ohio are required to file OH Bob Evans Form 335.

How to fill out OH Bob Evans Form 335?

To fill out OH Bob Evans Form 335, businesses must provide accurate financial information, including total income, allowable deductions, and any applicable tax credits, as well as complete identifying details and signatures.

What is the purpose of OH Bob Evans Form 335?

The purpose of OH Bob Evans Form 335 is to facilitate the reporting and claiming of tax incentives offered by the state of Ohio for businesses participating in the Bob Evans program, to encourage economic growth and job creation.

What information must be reported on OH Bob Evans Form 335?

The information that must be reported on OH Bob Evans Form 335 includes the business's name, address, federal tax identification number, total income, qualified deductions, applicable tax credits, and any other relevant financial details.

Fill out your OH Bob Evans Form 335 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH Bob Evans Form 335 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.